WHAT IS AN AVC?

WHAT IS AN AVC?

An AVC is an Additional Voluntary Contribution that you can make in addition to your normal contributions to an occupational /company /employer pension scheme in the public or private sector to increase your retirement benefits.

The main purpose of AVC’s is to bump up your pension benefits that your employer’s pension scheme is providing for you.

Please see the infographic of how company/occupational pensions work.

If you are a member of a company/occupational pension scheme, both you and your employer usually contribute into your pension fund. AVCs on the other hand are, as their name says, voluntary, so it is usually only the employee that contributes into this additional pot of pension money. These additional contributions still qualify for tax relief at your marginal rate of tax that you pay (subject to revenue limits).

AVC Access

Access to your AVC pension pot is restricted to the access/draw down rules of your main employer pension scheme. This is usually age 60-65.

DO YOU NEED AN AVC?

DO YOU NEED AN AVC?

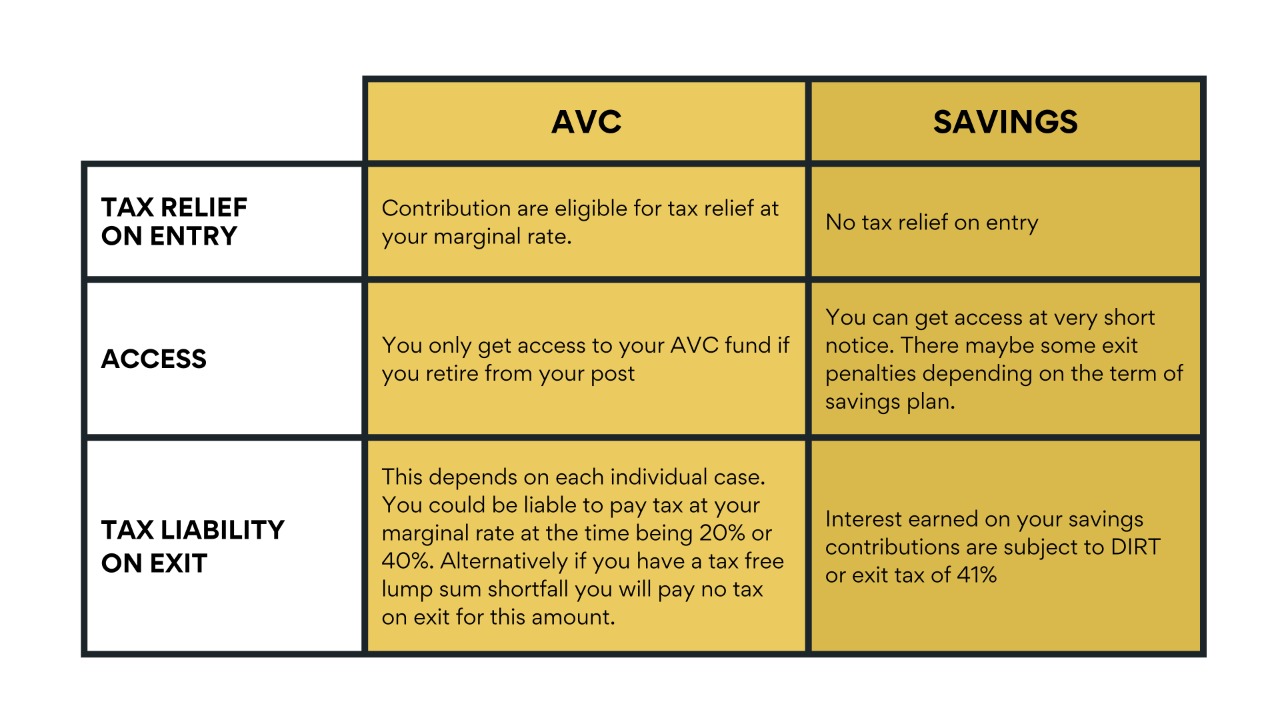

AVCs can be a very beneficial way of saving, but if you are thinking of starting an AVC, it is advisable to do some number crunching to assess the tangible tax benefits of your contributions. All AVC contributions qualify for tax relief at your marginal rate of tax, but many employees (especially civil servants or members of Defined Benefit Pension schemes) may find themselves paying a huge tax bill on these funds on retirement.

For example, if a member of a defined benefit pension scheme is overfunded in their AVC, their fund may be liable to a 52% tax charge on retirement. Alternatively, if the same employee has a tax free lump sum shortfall, then they usually pay no tax on their AVC pension pot when you draw it down at retirement.

So as you can see, it is very important to do some financial planning before deciding whether to start, stop or restart your AVC.

In many cases there may be no real tax relief or benefit of paying into an AVC as opposed to a Regular Savings plan. (A comparison of AVCs vs Savings is explained below.)

AVC Vs Regular Saving Plan

AVC Vs Regular Saving Plan

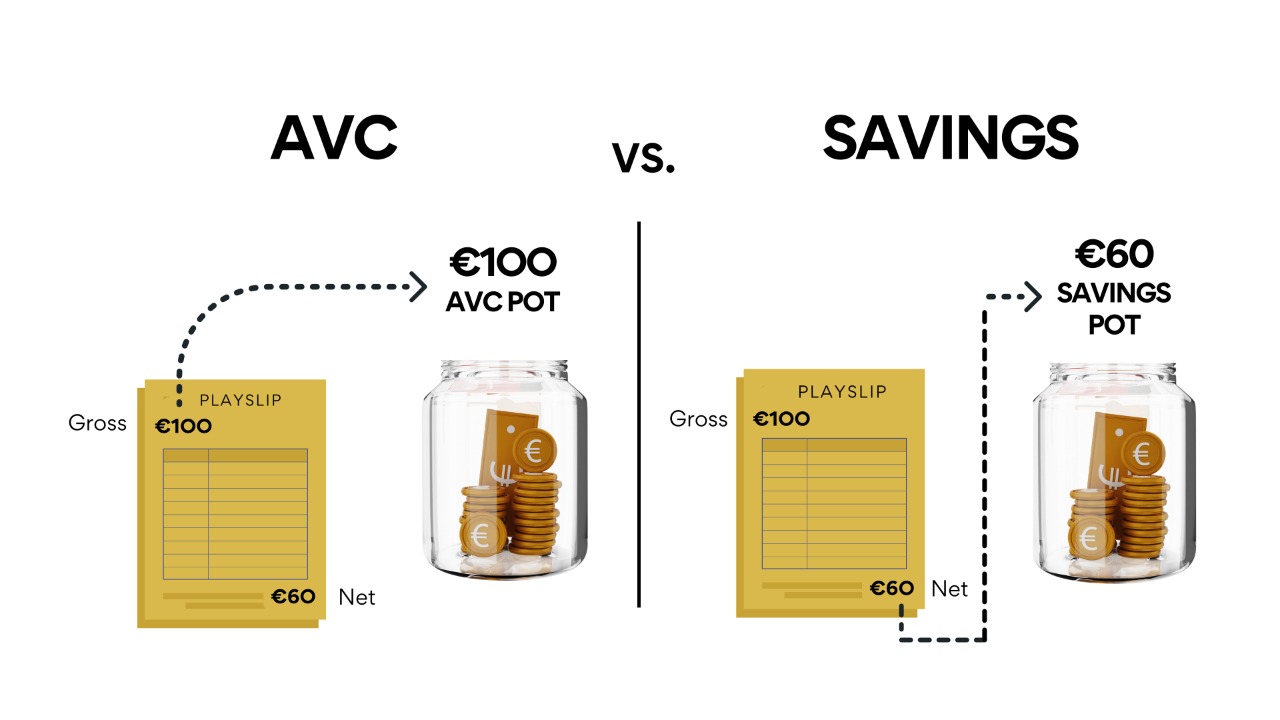

The info-graphic below compares an employee on a marginal rate of tax and the difference between contributing €100 of his Gross (pre tax) wages into an AVC vs a Savings plan.

As you can see from above, the AVC contributions are made on the employee’s gross (pre-income tax) earnings of €100 as compared to his net income (post income tax) of €60 with a savings plan. (Please note the above example ignores charges).

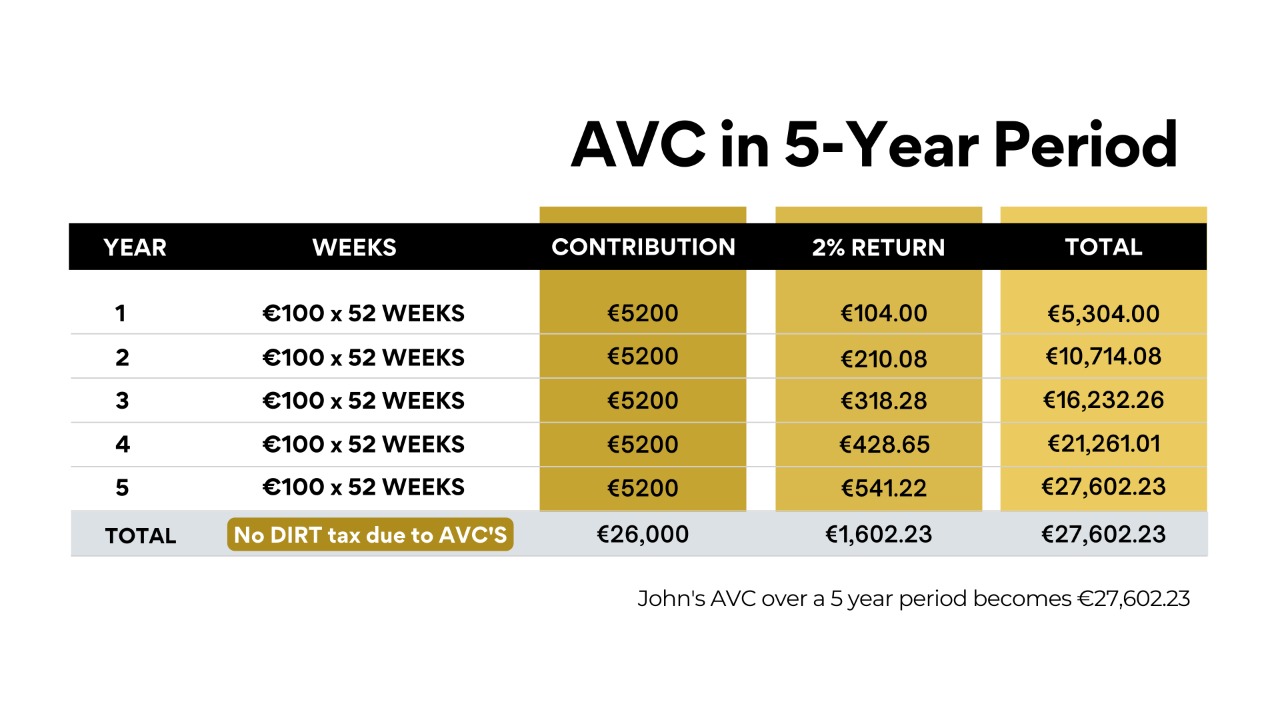

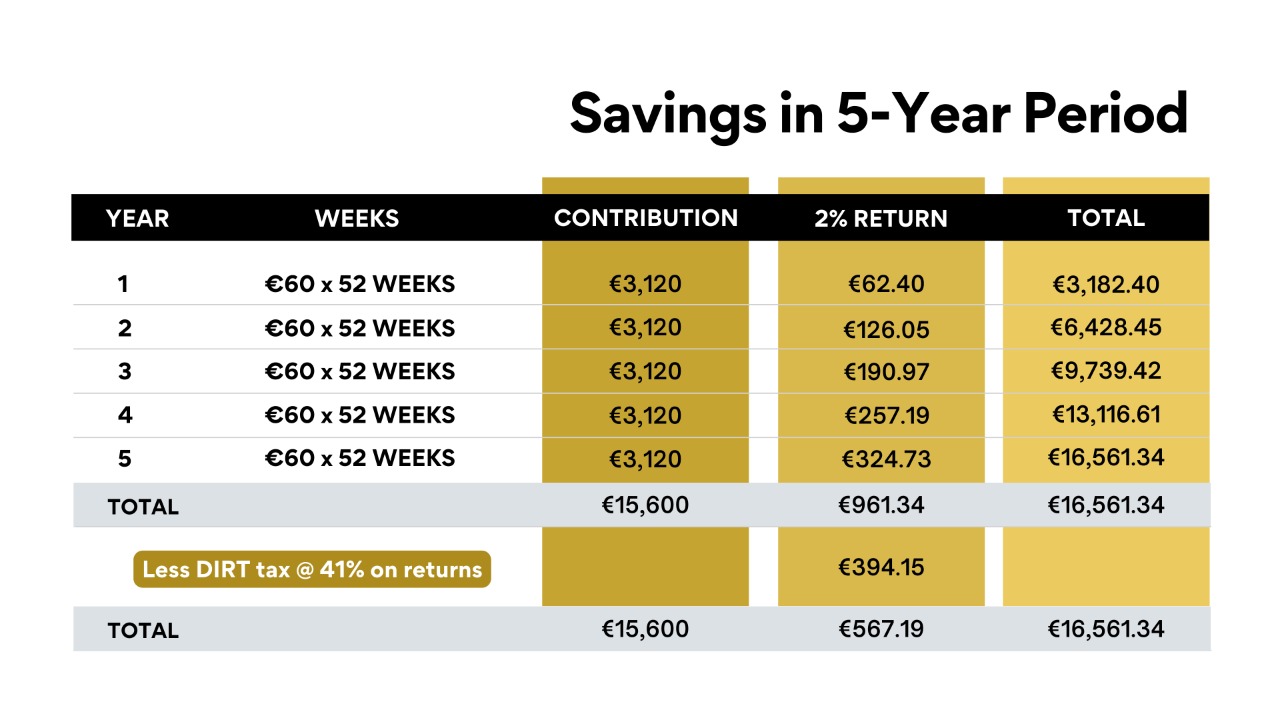

The extra €40 that goes into your AVC due to the relevant tax reliefs can have a hugely positive impact on your fund over a long period of time. The info-graphics below compare an employee, who is in the 40% income tax bracket, contributing the same gross wages (€100) to both an AVC and a Savings Plan on a weekly basis over a 5-year period.

Public Sector AVC

Public Sector AVC

If you are a public sector employee, AVCs are a very popular form of savings. Please click on the button below which goes into more detail about Public Sector AVCs.