An Approved Retirement Fund (ARF) is a post-retirement financial product that offers the opportunity to reinvest your pension value after retirement and after you draw down the initial tax-free lump sum.

It allows you to take a portion of, or the entire remainder of, your pension and invest it in the new fund to accrue additional value through your retirement years.

Investing your pension in an ARF is often attractive as it allows a lot of flexibility in how your fund is invested. Any funds you accrue through the investment are allowed to grow tax free.

When are ARFs Required

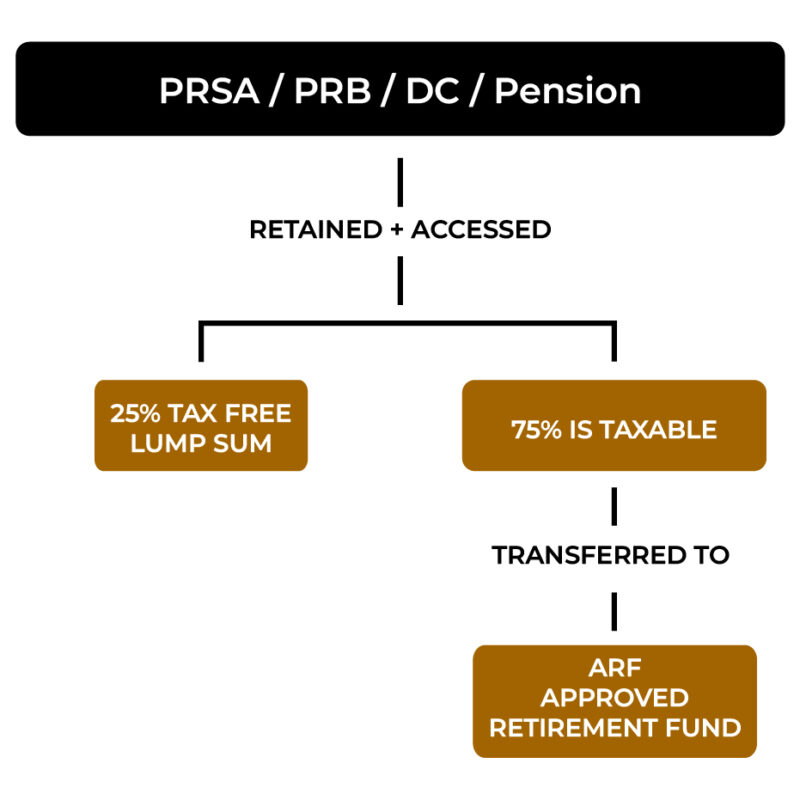

For most defined benefit Pension schemes, once the pension owner decided to retire/access this pension, the following process occurs

- 25% of the Pension value is received as a tax-free lump sum

- The remaining 75% is then transferred into an Approved Retirement Fund (ARF)

So if you have a one of the following

- A previous Pension/Overseas Pension that has been transferred into a Personal retirement bond or PRSA

- Reached retirement age of a defined contribution Occupational Pension scheme

- Have a Self Employed Personal Pension

- An Overfunded AVC of a defined benefit pension scheme

Once the fund is retired and accessed, the remaining 75% of the fund is then transferred into an ARF.

ARF Rules

- All withdrawals from an ARF are taxable as income and is taxed under normal PAYE taxation rules (liable for income tax, PRSI and USC). ARF withdrawals are similar to any income of the individual state pension, Wages (if still working in another job as a PAYE employee) etc.

- From age 61 onwards, a compulsory withdrawal of 4% of the Fund value must be taken from the ARF each year. This is called Imputed Distribution. The imputed distribution is increased to 5% from age 71 onwards.

- Additional withdrawals can also be taken but these are not compulsory.

- The ARF lasts as long as the funds last. They will often ‘Bomb out’, meaning that all funds will eventually be withdrawn and the ARF is then closed.

- On death, if there are still funds within the ARF, the full fund value of is left to the pension holders estate and is taxed as inheritance (taxed under normal inheritance tax rules etc (See below for more detail)

- Please note that you cannot make regular contributions into an ARF, only the taxable portion of a retired pension (mentioned above) can be transferred into an ARF.

Who provides ARFs

All of the main Pension providers off ARF to retired pension holders (Aviva, Zurich, Royal London, Irish Life, New Ireland Assurance, Royal London)

Where are ARF funds invested

ARF funds are usually invested in a multi Asset fund with one of the providers mentioned above. These can be low, medium or high risk funds). The ARF owner has complete control of where and what company he/she chooses and where the fund is invested. Often ARFs are transferred from one provider to another in order to match with the best provider and investment on the market at a particular time period.

ARF on Death

The full fund value of an ARF of an individual is passed to his/her estate as follows

- If the spouse is still alive, the full ARF value is transferred tax free to him/her. However all withdrawals from the ARF in the future are classed as income and liable for income tax PRSI and USC

- If both spouses have passed or the ARF holder is not married/divorced,

- any children under 21 are liable for inheritance tax on the full fund value ( becomes part of the lifetime exemption limit of €335000 of each child etc). Often no tax liability is not due here at all.

- Any child over 21 pay a flat tax fee of 30% of the ARF value only.