‘Children’s Savings Plans specifically tailors to mitigate and future gift/inheritance tax liability’

There is a lifetime limit from Parent to Child of €335,000 per child of either gifts or inheritance. Once your total assets value exceeds this threshold, a 33% tax is payable on this excess.

There are many tax efficient ways of reducing your gift/inheritance tax liability.

One of the best ways of potentially reducing an inheritance liability is to transfer as many assets into your children’s names before your death’s as possible. However, care needs to be taken to avoid any capital gains or gift tax liability, which is also calculated at 33% on all qualifying assets.

Assets can be transferred from parents to children in many ways. One of the best and easiest ways of doing this is to set up a Gift/Inheritance Tax Savings plan for each child.

How does these work?

- These savings plans allow each parent to transfer the annual gift exemption of €3000 each year to each child without triggering any gift or inheritance tax liability.

- The savings plans are not owned by the you – they are owned by your child.

- All funds and any potential future returns are exempt for any CAT liability.

- The €3000 contribution can be made monthly (€250) or annually to each policy.

- The child can access these savings plans until their 18th

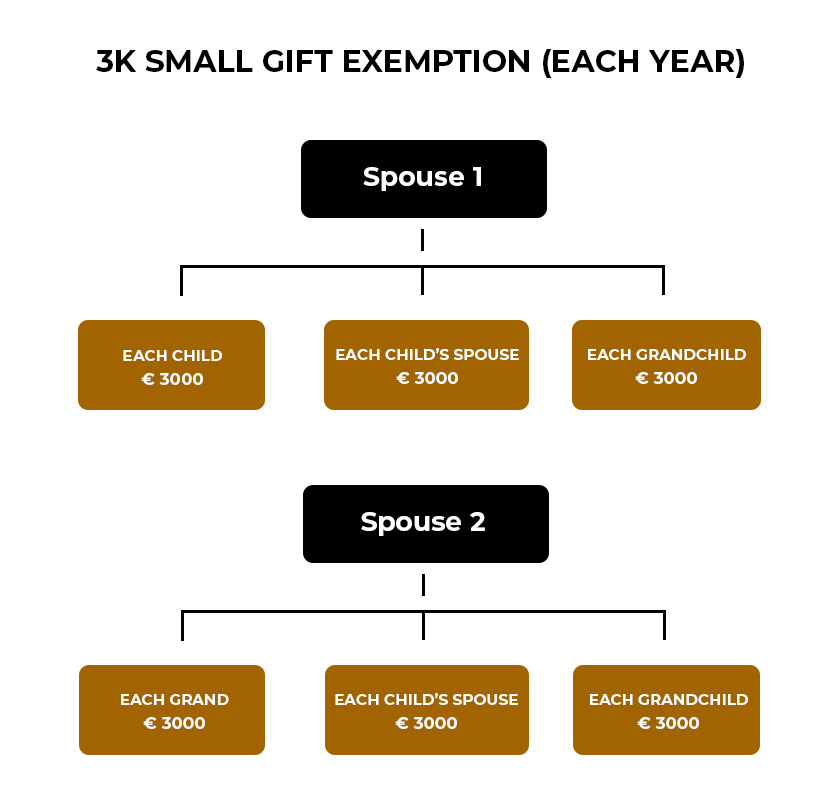

What family Members can qualify for this plan?

- All children

- All spouses of your children

- All Grandchildren

Please note that each parent can contribute €3000 for each qualifying family member. For example €6000 can be gifted to each child (€3000 per parent).

If an Inheritance Tax Savings plan was set up for a child when they were born, €108000 would be sitting in a savings plan for them at their 18th birthday with no Gift or inheritance liability due. (This is ignoring any potential investment returns on the funds invested over the term. ).

Who Provides these Savings Plans

Most Insurance Provider in Ireland provide these plans namely Irish Life, Zurich, Aviva, New Ireland, Standard Life.

How are these Plans Set up?

- A Separate Savings plan is required for each recipient.

- The funds are debited from you and/or your spouses bank account and into the savings plan (either monthly or annually).

- You own the policy until the recipient is 18 years of age

- You are in control of how much is invested, where it is invested etc.

Where are these Funds invested.

Your funds are usually invested in a Multi Asset Fund with the chosen Insurance Provider. These funds can be a low, medium or High risk fund.- its completely up to you. Before the savings plan is set up, a chosen multi asset fund is required however you can change is very easily (within 24 hours if you wish).