Background to DB Pensions

Defined Benefit Pensions are not as common in Ireland as they once were. The pension benefit received with these types of pensions are usually calculated/earned from each employee’s year’s of service with this employment and their final salary. The pension benefits are received by the employees on retirement as follows;

- A Tax-free lump sum is received at normal retirement age (NRA)

- An annual pension income is received at NRA and payable for life.

Leaving a pensionable job prior to NRA

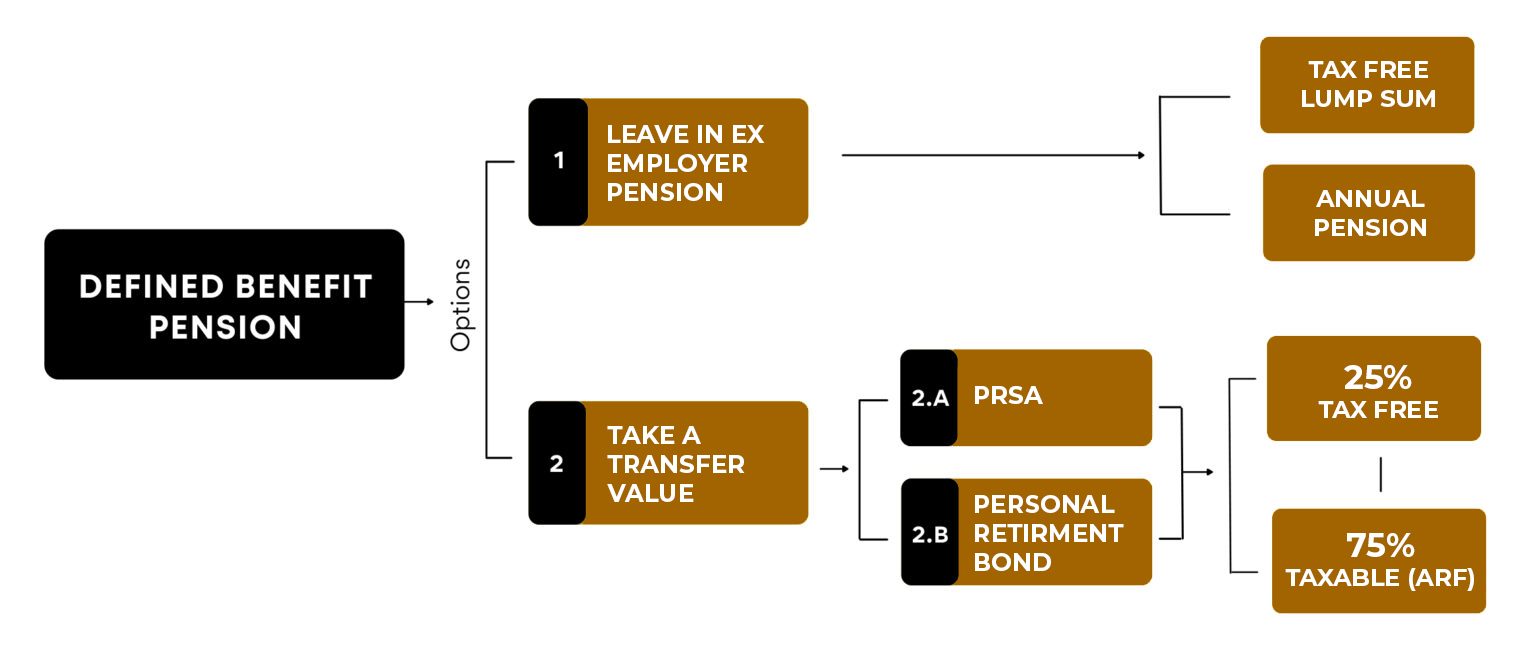

If an employee leaves their job before their normal retirement age, they will be offered the following options in relation to their pension;

Option 1:

LEAVE IT WHERE IT IS – IN THE EX-EMPLOYERS PENSION SCHEME.

If this option is chosen, this deferred pension entitlement will be left in ex-employers pension scheme.

- Access to the pension

Access is usually restricted to the normal retirement age of the main pension scheme (usually 60 or 65 etc)

- How the Pension funds are received ?

On drawdown, the following entitlements are received by each ex-employee;

- A Tax-Free Lump Sum

- An Annual Pension income

The Pension lump sum is received tax-free on retirement and the annual pension income is taxed as income (liable for PAYE, PRSI (until age 66) and USC.

Tax implications on death

- Death – Pre Retirement – If the pension owner dies prior to the Normal retirement age of this pension scheme, a tax free death benefit of usually 1.5 times Salary (salary at date of leaving this employment) is be payable to the surviving spouse. 50% of the annual pension income is also usually paid to the surviving spouse until his/her death. This income is taxable (Income tax/PRSI/USC etc.). If widowed/divorced/single, the pension annual income dies with the pension owner. No benefit is passed down to their next of kin (children).

- Death – Post Retirement – On death of the pension owner, there is no lump sum benefit payable. However 50% of the annual pension income is paid to the surviving spouse until his/her death. This income is taxable (Income tax/PRSI/USC etc.). If widowed/divorced/single, the pension annual income dies with the pension owner. No benefit is passed down to their next of kin (children).

OPTION 2:

ACCEPT A Pension Lump sum TRANSFER VALUE in lieu of their annual pension entitlement (explained in option 1).

This Pension transfer value offered is a usually sizable lump sum. It is predominantly calculated as a multiple of the annual pension entitlement from point 1 above (between 15-20 times the annual pension income entitlement) by the pension trustees/actuaries of the main Occupational pension scheme. Some of this Lump Sum is received tax free and some may be taxable when accessed (depending on the financial circumstances of the pension recipient).

Once the transfer value option is taken, the full fund value is then transferred into one of the following.

2.1 – A new Employers pension scheme (rarely advisable)

2.2 – Either a PRSA or a Personal Retirement Bond (PRB) with one of the Pension Providers (Irish Life/Zurich/Aviva, etc).

Below is a detailed analysis of these 2 options;

2.1 Transferring to a New Employer Pension Scheme explained

If the new employer pension scheme is also a defined benefit pension scheme, then all of the access and draw down rules are similar to the rules mentioned in option 1. However, if the new employer pension is defined contribution, then the following rules apply ;

- Access to the pension

Restricted to the Normal Retirement Age of that pension scheme (usually 60 or 65)

- How pension benefits are received and taxed?

Defined Contribution Occupational pension schemes are usually accessed as follows;

- 25% of the Pension fund is usually received as a tax free lump sum

- The remaining 75% is usually either

- Taken as Taxable cash or

- Transferred into an Approved Retirement fund (ARF) or a Vested PRSA

- It is rarely advisable to take the remaining 75% of the pension fund as taxable cash as you can end up giving half of the fund value to the revenue as a taxe liability. Transferring these funds into a Approved Retirement fund (ARF) or a Vested PRSA is usually the preferred and most tax efficient method to choose. The pension funds withdrawn from the ARF/Vested PRSA are taxable as income – liable to PAYE, PRSI (until age 66), and USC. This ARF/Vested PRSA income can be received monthly/quarterly or annually, whichever pension holder chooses. An annual minimum withdrawal of 4% of the total pension fund value is compulsory from age 61, but they can withdraw as much as they wish from this pot of money at any time. It is prudent to withdraw these funds tax efficiently. It is possible to pay very minimal taxes (if any at all) on this income if certain annual income limits and thresholds are not exceeded.

Transferring into a new employers Defined Benefit Pension scheme is rarely advisable. Many people who start working in the public sector later in their working career often transfer any previous employment pensions into the public sector superannuation pension scheme to bump up their public sector pension on retirement. However, this rarely makes financial sense and is not advisable. - Tax implications on Death – pre retirement In the event of death prior to Normal retirement age (NRA) of your new employer defined contribution pension scheme, the full fund value is left to the surviving spouse. However, this benefit cannot exceed 4 times final salary If widowed/divorced/single – the pension fund is left to next of kin (children) as and taxed as inheritance. No tax is paid if the lifetime limit of €335000 gift/inheritance threshold is not exceeded.

If the new employers pension is a defined benefit scheme then a tax free death benefit of usually 1.5 times Salary (salary at date of leaving this employment) is be payable to the surviving spouse. 50% of the annual pension income is also usually paid to the surviving spouse until his/her death. This income is taxable (Income tax/PRSI/USC etc.). If widowed/divorced/single, the pension annual income dies with the pension owner. No benefit is passed down to their next of kin (children). - Tax implications on Death – Post Retirement – If the pension holder has reached Normal Retirement age of his new employers defined contribution scheme and a tax-free lump sum received prior to death, the remaining funds will usually have been transferred into an ARF/Vested PRSA. On death, these benefits are then passed onto the surviving spouse tax free. However withdrawals from the ARF/Vested PRSA are taxable as income. If widowed/divorced/single, the remaining funds within the ARF/Vested PRSA are passed onto next of Kin (usually children). Children under 21 are taxed under normal inheritance tax rules but may pay no tax if their lifetime limit for gift/inheritance limits/thresholds of €335000 are not exceeded. (see table below). Children over 21 are not taxed as inheritance but instead pay a compulsory standard tax rate of 30% on funds due from ARF/Vested PRSA. If the new employers pension is a defined benefit scheme then 50% of the annual pension income is paid to the surviving spouse until his/her death. This income is taxable (Income tax/PRSI/USC etc.). If widowed/divorced/single, the pension annual income dies with the pension owner. No benefit is passed down to their next of kin (children).

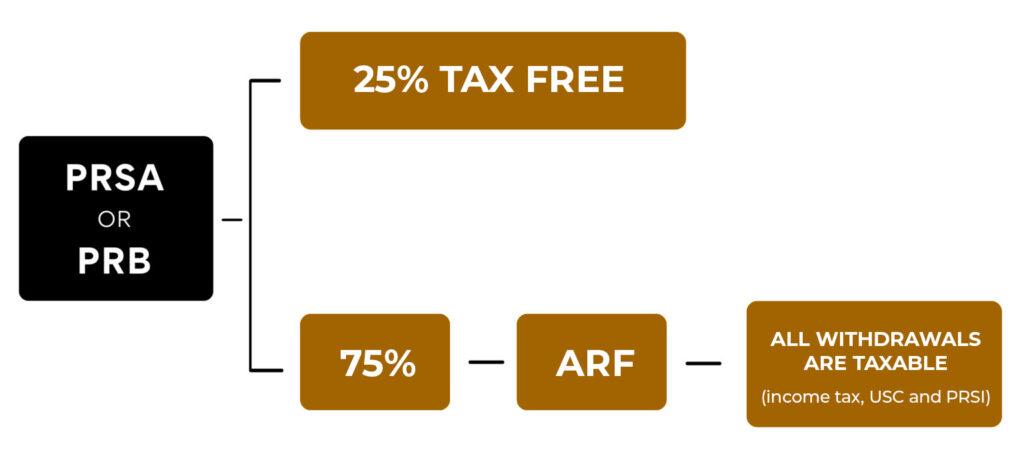

2.2 – Transfer the full Pension Value to a Personal Retirement Bond (PRB) or PRSA with one of the main pension providers in Ireland.

- Access– access to the a PRB or a PRSA can be gained from age 50 onward. This is a HUGE benefit when compared to the other options.

- How are the pension benefits received and taxed?the most tax efficient of the following calculation/options;

- 25% as tax free lump sum with the remaining balance invested in an ARF/Vested PRSA or

- 5 times salary as a tax-free lump sum with the balance used to purchase an annuity (annual pension income).

Both the withdrawals from the ARF/Vested and the annuity income are taxed as income and liable for income tax, PRSI and USC.

- Tax implications on Death – Pre Retirement– In the event of death prior to Normal retirement age (NRA), the full fund value is left to the surviving spouse. If widowed/divorced/single – the pension fund is left to next of kin (children) as and taxed as inheritance. No tax is paid if the lifetime limit of €335000 gift/inheritance threshold is not exceeded. Please see figure 1.2 for inheritance tax table thresholds/limits.

Tax implications on Death – Post Retirement – If the pension has been retired and a tax-free lump sum received by the pension holder prior to death, then the remaining funds will usually have been transferred into an ARF/Vested PRSA. These benefits are then passed onto the surviving spouse tax free. However withdrawals from the ARF/Vested PRSA are taxable as income. If widowed/divorced/single, the remaining funds within the ARF/Vested PRSA are passed onto next of Kin (usually children). Children under 21 are taxed under normal inheritance tax rules but may pay no tax if their lifetime limit for gift/inheritance limits/thresholds of €335000 are not exceeded. (see table below). Children over 21 are not taxed as inheritance but instead pay a compulsory standard tax rate of 30% on funds due from ARF/Vested PRSA

PLEASE NOTE:

Public sector occupations employed by the Department of Education, HSE cannot take a transfer value for their pensions. However, most semi-state bodies can (Eircom, An Post, Banks, etc).

Deferred pension holders of such companies as Eircom, Intel, An Post, many Ulster Bank employees, Bank of Ireland, AIB, Ulster Bank, etc. have all been offered ‘Enhanced Transfer Values’ with this new draw-down pension option.

Points to consider before choosing.

Points to consider before choosing which option to take

There are advantages and disadvantages to each option below is a brief breakdown of these for each option

Option 1 – leaving it in your ex-employers DB pension scheme

- Advantages

- A set tax free lump sum at retirement and an annual pension, payable for life – no matter how long you live

- 50% of the annual pension left to surviving spouse on death

- Disadvantages

- No guarantee that your previous employer will have the funds in its penson scheme to pay for your annual pension income e.g mismanagement of company pension funds/company closing down or moving out of Ireland etc.

- Your ex-employer can change the rules of the pension scheme if the company scheme is underfunded changing retirement age/changing the scheme to a defined contribution scheme.

- You have limited Control with your pension as long as it is part of the main pension scheme

- As the annual pension income is taxable, the pension recipient could end up pay up to 40-52% tax on this annual pension income if this annual income of the pension recipient is significant.

- You don’t have the option to take any additional lump sum from pension pot after the initial tax free lump sum is taken.

If divorced/widowed/single on death, your pension dies with you and your children get nothing.

Option 2 – Taking the transfer Value and transferring the funds into a new employer’s pension scheme

There are rarely any advantages of transferring your previous defined benefit pension into a new employer defined benefit pension scheme. All of the rules, tax implications, access/retirement ages and death benefits are very similar.

Many people who start working in the public sector later in their working career often transfer any previous employment pensions into the public sector superannuation defined benefit pension scheme in order to ‘buy back pensionable years or service and bump up their public sector pension on retirement. However, this rarely makes financial sense when the cost associated with buying back these years are analysed against the potential increase in annual pension income.

Transferring to a new employer defined contribution pension scheme may be worth considering on occasions. However the majority of benefits gained from this transfer would be gained by option 3 – transferring it into a PRSA or a PRB (see below) as well as earlier potential access to the pension funds.

Option 3– Taking the transfer value offered by your ex-employer and transferring to a PRSA/PRB

- Advantages

- Early access from age 50 onwards

- Full control of where your pension is invested

- Mitigate any risk of mismanagement of pension by ex-employer

- Flexibility on how much you can withdraw from your ARF/vested PRSA. e.g. if you need extra funds withdrawn for whatever reason (eg car purchase, house renovations, holiday cruise etc.

- On death, the full fund value of the pension is left to your next of kin. It is particularly advantageous if divorced/widowed/single.

- More flexibility with annual withdrawals in order to reduce or eliminate any tax liabilities. Eg. If a married couple over 65 keep all incomes under €36000, they will face a zero-tax bill on this income. However if incomes exceed this threshold, all the income is liable for normal PAYE taxes.

- Disadvantages

- The transfer value offered by your ex-employer may not be value for money.

- No set income for life

- Your Pension fund can ‘bomb out’ (run out) while you are still alive if you withdraw too much too early.

Can experience negative returns on your pension fund if you choose an unfavorable/high risk investment strategy.

Conclusion

There are pros and cons to each option as explained above.

The transfer values offered to deferred Defined benefit pension holders are calculated by their ex- employers pension actuaries department. These values can go up and down over a period of time. Whether or not this is the preferred option for you, there is absolutely no harm in requesting a transfer value from your employer to assess all of your options. You can then make an informed decision of what is the best option for you and your financial future.

If you would like any assistance in making your decision you can contact book a free consultation with one of our Highly qualified and experienced Pension Specialists.

Below is a list of the main pension related queries we help our clients with;

- Requesting transfer values from previous employers

- Tracing and locating old pensions

- Advising on the most tax efficient option available in relation for pension transfers

- Early access options

- How to maximize your tax free lump sums receivable,

- Receiving pension income post retirement and taxes payable

- Death benefit analysis – pre and post-retirement

- Future Cashflow analysis in a report format helping clients see their financial future with each pension transfer option.

- Assist in choosing the best pension provider for any pension transfer in relation to

- Fees and charges

- The best investment fund performance

- The customer service support

- Choosing the best investment strategy that suits your requirements

- Ongoing Management of client’s pensions – pre and post retirement