Public Sector Superannuation Schemes

The majority of Civil Servants who commenced full-time employment in a public sector position is a member of one of the 2 main Superannuation schemes.

- Pre 2013 Superannuation Scheme

- New Single Superannuation Scheme – Post-2013

Both of these schemes provide life insurance, sick pay entitlements and pension benefits to its members.

In order to qualify for these benefits, contributions must be made to earn these benefits.

In order to qualify for these benefits, contributions must be made to earn these benefits.

Compulsory Contributions to earn Superannuation Entitlements

The 2 main compulsory contributions are as follows:

1. Pension Contributions

For each payslip, a contribution of roughly 5% of your Gross (before Tax) earnings are made.

These are compulsory contributions and are usually visible on each payslip (right-hand side). The deductions can be named differently on your payslip, depending on which department you are being paid from. The most popular titles for these deductions are:

- Pension Grouped

- Pension 170

- Additional Superannuation Contributions (ASC)

2. ‘Spouses and children’s Benefit’ deduction

Another compulsory deduction that is visible on most payslips is called Spouses and Children’s benefit. This can often be named ‘1.5% Sp &Ch’ on your payslip. This deduction entitles you to a Death-in-Service benefit (see below)

Superannuation Benefits and Entitlements

Every year you work, you earn entitlements as a public servant from whichever superannuation scheme you are a member of. The benefits and entitlements are calculated differently with each scheme. Generally speaking, the Pre-2013 scheme benefits are more significant, particularly when comparing the pension entitlements. The tax-free lump sum and pension entitlements are roughly 40% more with the Pre 2013 scheme than the post-2013 scheme.

Public Sector Superannuation Scheme – Pre 2013

Benefits and Entitlements

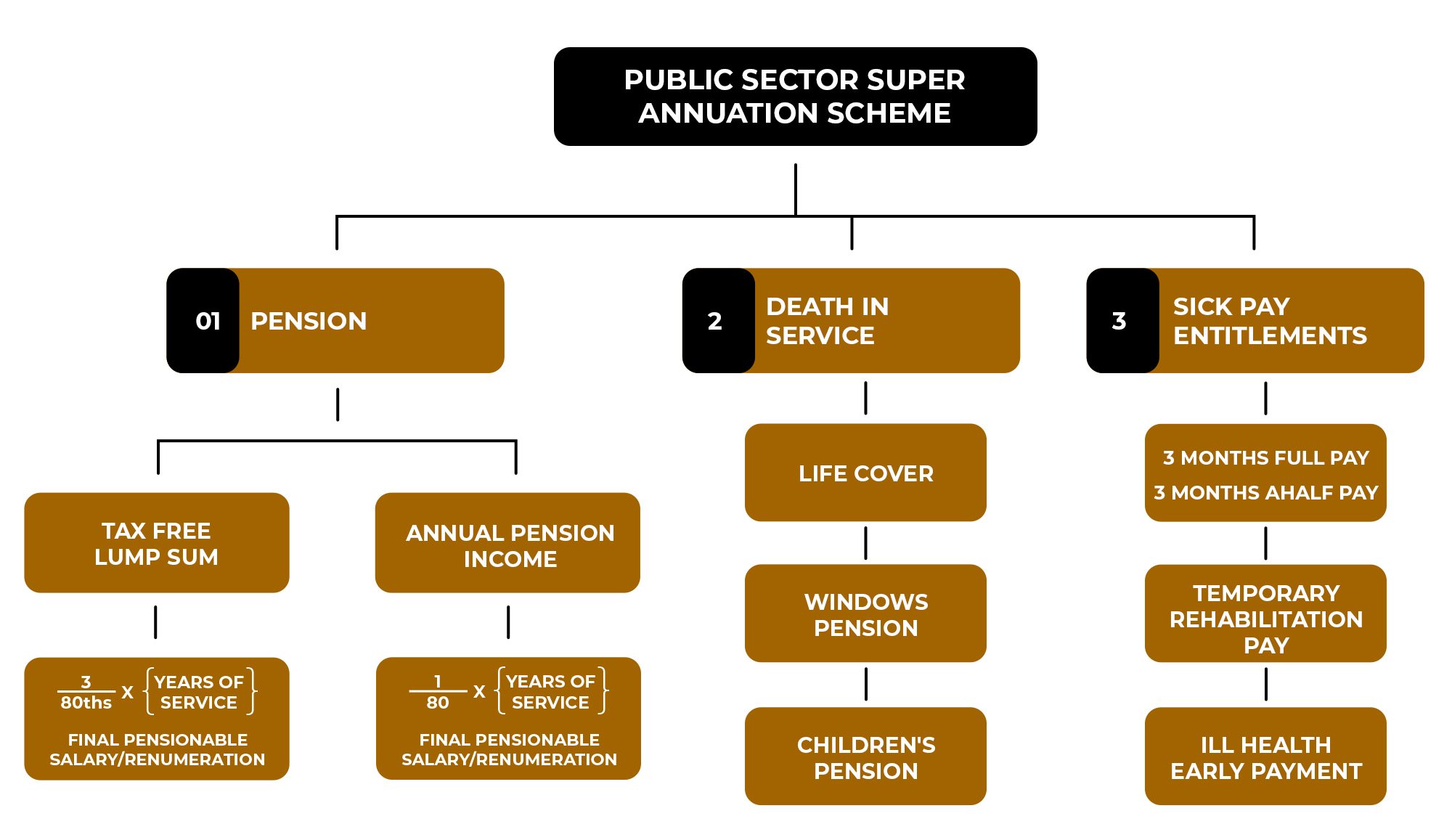

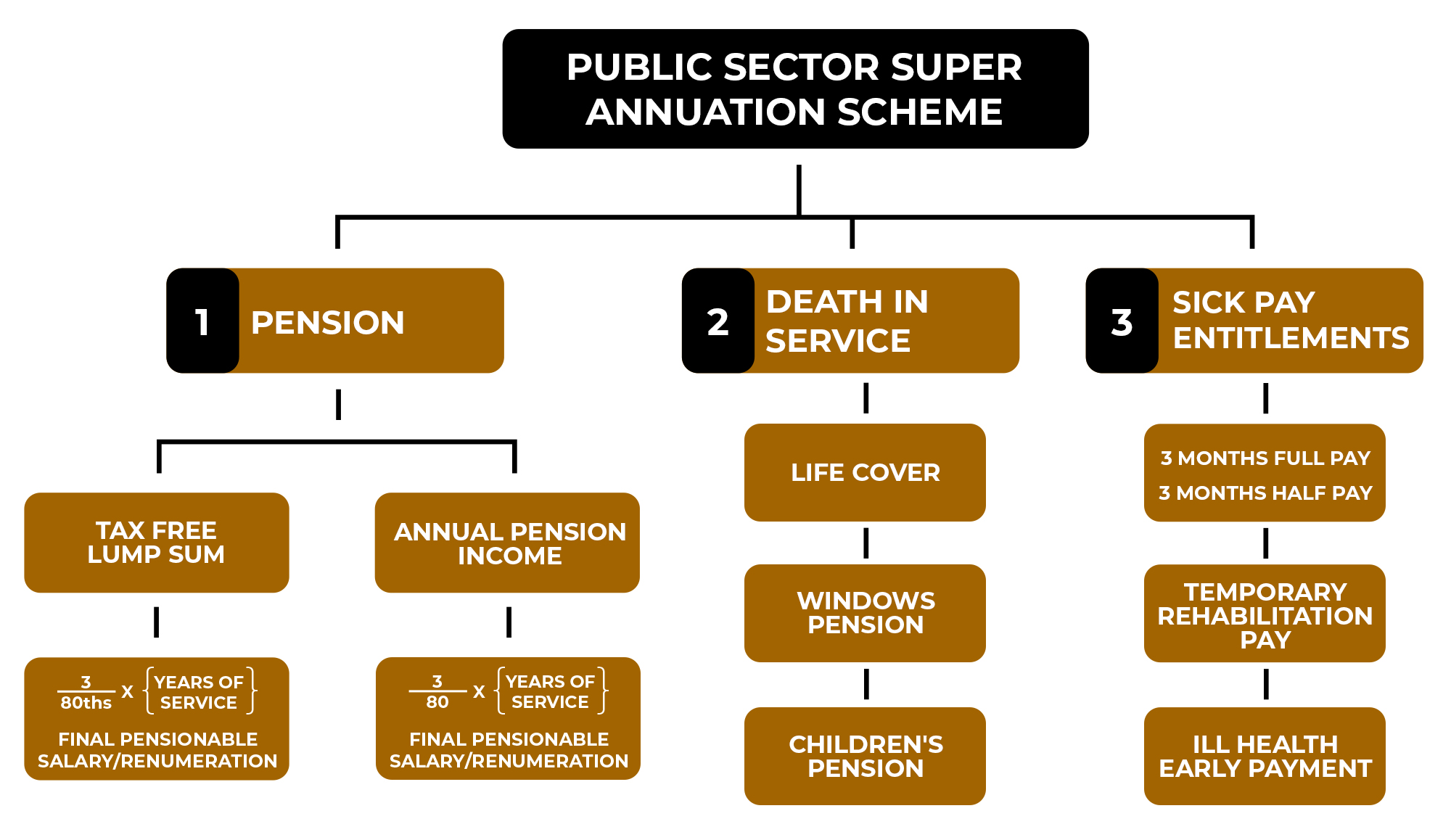

The illustration below demonstrates the basic Superannuation Scheme entitlements

The 3 main entitlements are broken down as follows:

- Pension Entitlements

- Death-in-Service Benefits

- Sick Pay Entitlements

1. PRE-2013 - PENSION ENTITLEMENTS

As a public servant you are entitled to 2 main pension benefits

1. A Tax Free Lump Sum

This is a lump sum of money paid tax free to you on retirement.

2. An Annual Pension income

- This is an annual income that will payable after you retire for the rest of your life.

- This income is received on a fortnightly/monthly basis, similar to how your current salary is paid now.

- You will receive a payslip from this income.

- All of this income is taxable – liable for income tax USC and PRSI (ceases at age 66).

How are these benefits calculated?

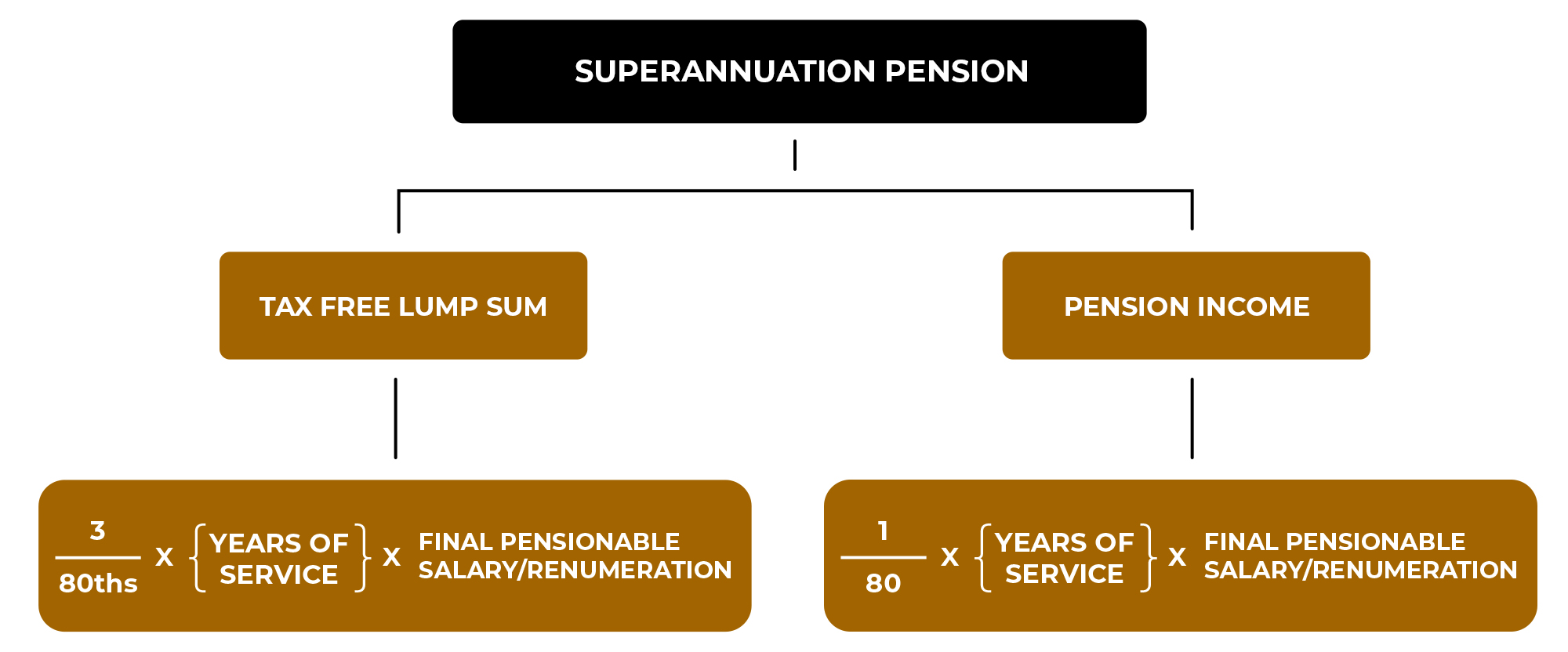

Every year you work, you earn pension benefits. Please see illustration below.

Tax Free Lump Sum Calculations

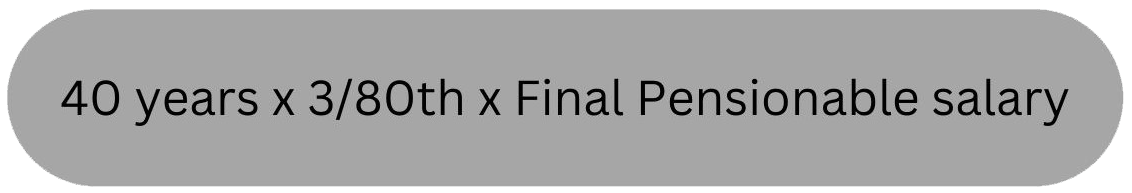

For every year that you work, you earn to 3/80ths of your final pensionable salary as a tax-free lump sum (TFLS). The calculation formula is below;

So, if you work 30 years as a public sector employee your lump sum calculation will be:

Service is capped at 40 years for pension purposes (including any added years entitlement – Guards/Fire Officers, etc)

Therefore, the maximum Tax-free lump sum that any employee can be entitled to is –

Example

John is a teacher. He is a class A1 employee and is on annual salary of €65,000. When John retires next year, he will have 30 years’ service worked. He will be entitled to a Tax-Free Lump Sum (TFLS) as follows; (30 years x 3/80th) x €65,000 = €73,125

If John decided to work on 2 extra years, then his years of service would increase to 32 years at retirement. His TFLS will be therefore be;

(32 years x 3/80th) x €65,000 = €78,000

Pension Income Calculations

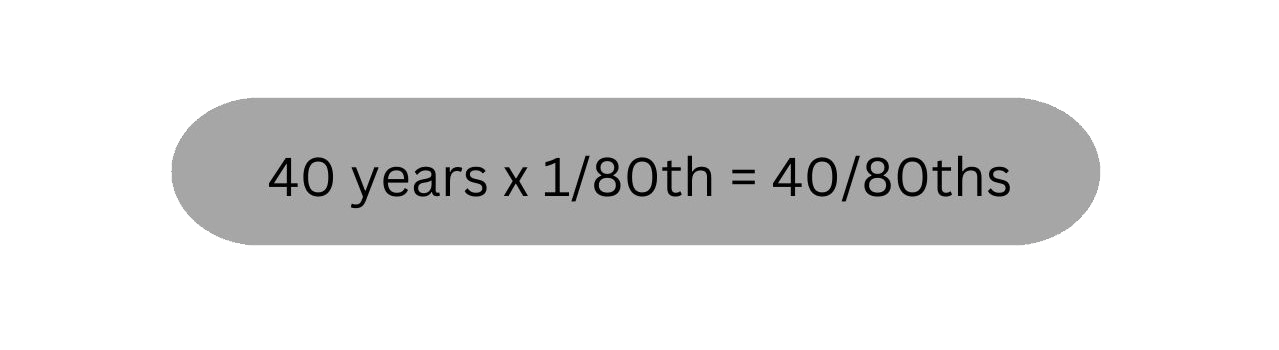

For every year that you work, you are entitled to 1/80th of your final Pensionable

Salary/Remuneration as a pension income on retirement.

The formula is as follows:

- If you had 30 years of pensionable service at retirement, then you would be entitled to 30/80th x your final salary.

- 40 years is the maximum number of years of service that a public sector can work for pension purposes. Therefore, the maximum pension entitlement is

Please note – when calculating these pension entitlement, final salary figure must be subtracted by 2 times the state pension entitlement.

So if your final salary is €65000 then €26344 (€13172 x 2) needs to be subtracted before the calculations.

Example

Johns has 30 years’ service completed at retirement, is aA1 PRSI payer and has a finalsalary of €65,000, his pension will be calculated as follows;30/80 x (€65,000 – €26344) = €14499

Please note that John will also be entitled to the state pension at 66 of €13172.

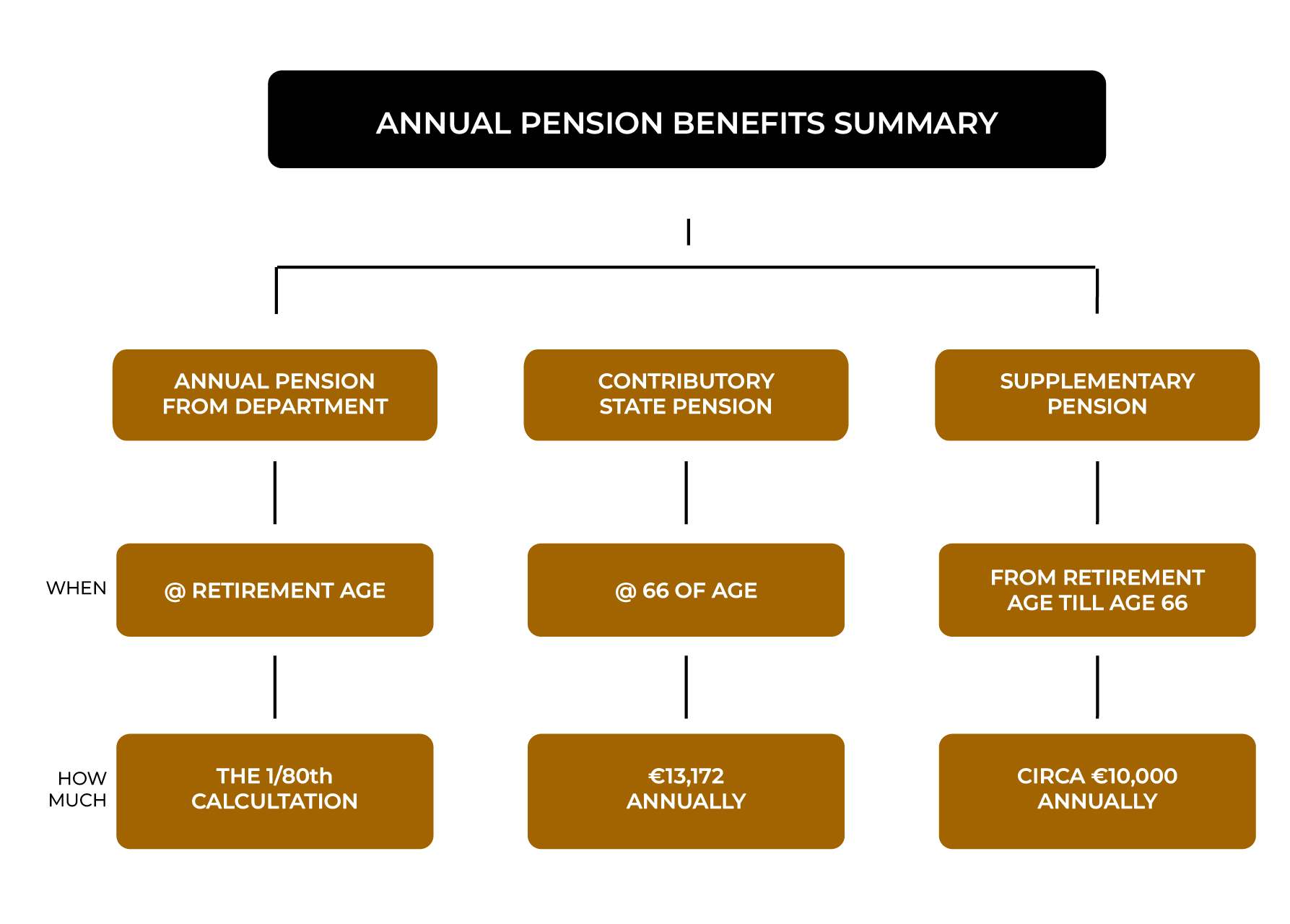

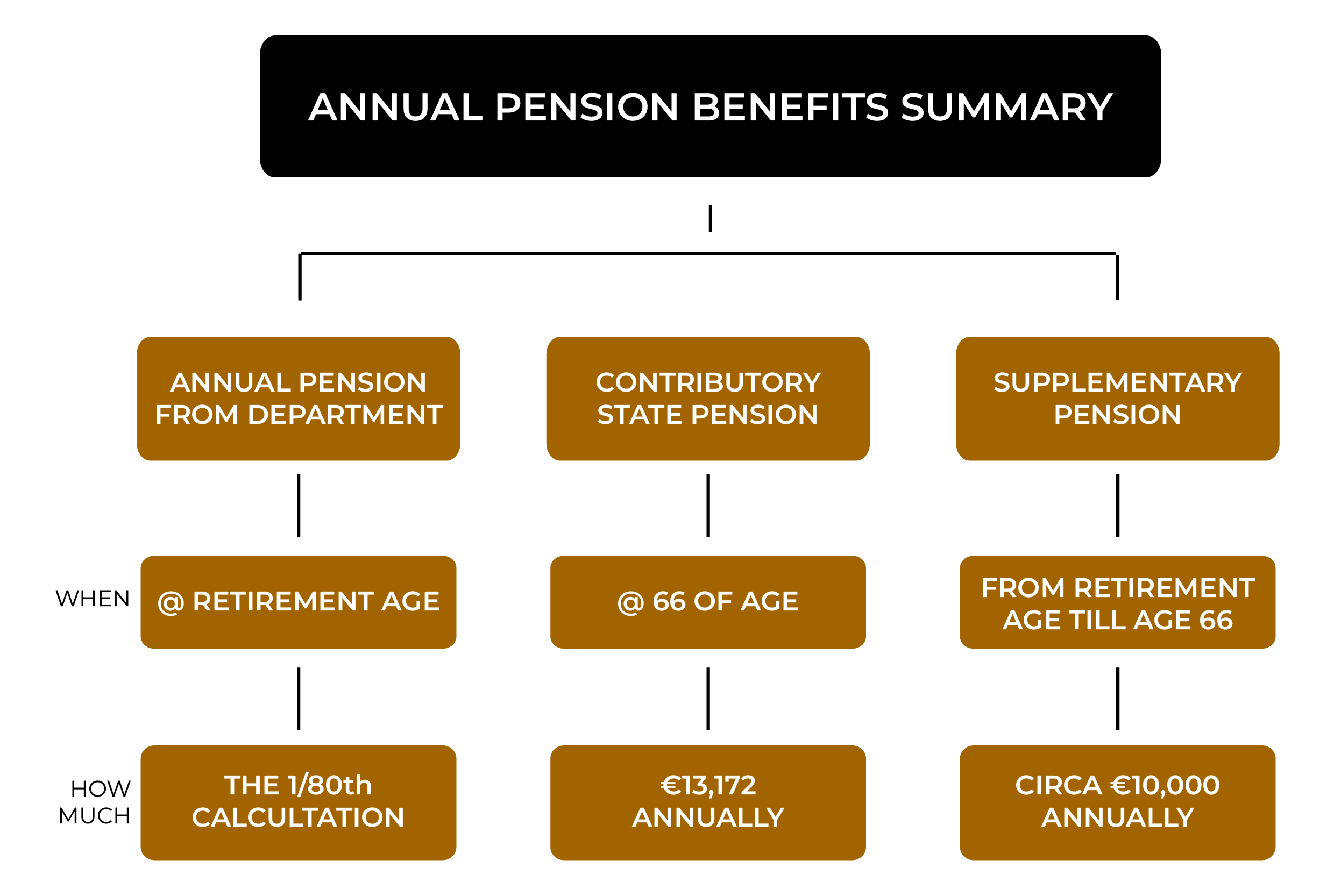

State Contributory Pension

- All A1 PRSI payers are entitled to the full contributory state pension.

- Most Public Servants who start work post 1st April 1995 are A1 PRSI payers

- At present, the state contributory pension is €253 per week or €13172 per year

- It starts paying from age 66 onwards (regardless of when you retire from the public sector).

Supplementary Pension entitlement

If you retire at your Normal Retirement Age but have some time to wait until your are entitled to the State Contributory Pension at 66, you will be entitled to a Supplementary pension entitlement- paid by your respective public sector department.

This entitlement is circa €10000 and is paid from your normal retirement age until the State pension age of 66.

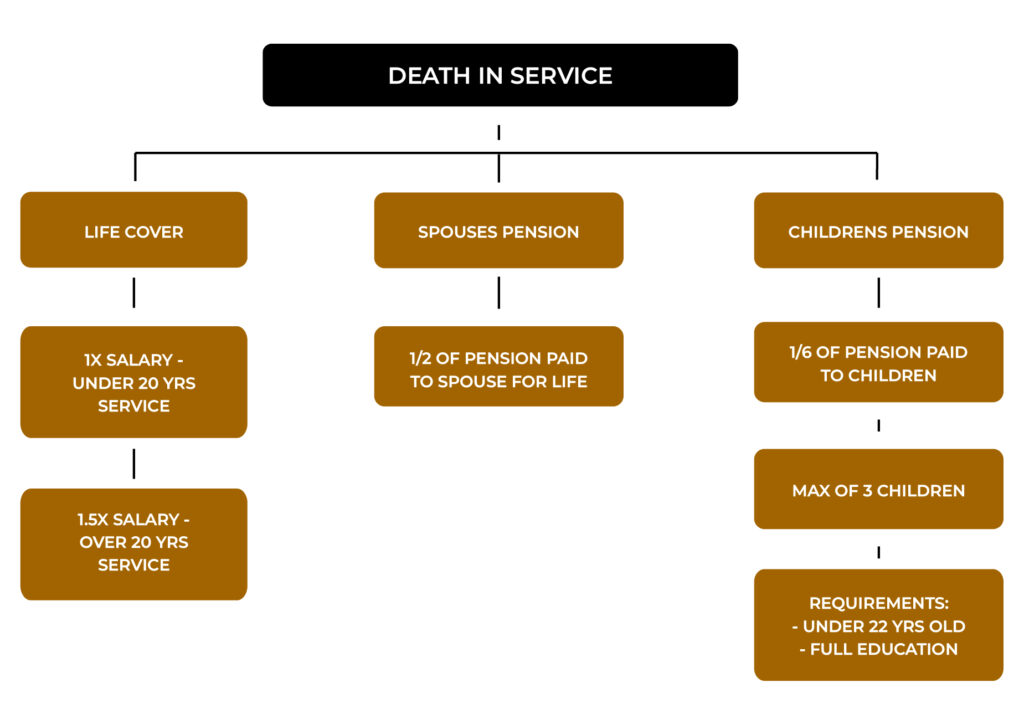

2. PRE 2013 - DEATH IN SERVICE

All public sector workers have automatic life cover entitlements with their job.

These entitlements are quite significant.

- Death Benefit

In general, ifyou die in service a lump sum of circa 1.5 times final salary is paid to your spouse/children.

- Pension Benefit

if you die in service or after retirement, there is a pension paid to your surviving spouse or civil partner, and where applicable your children. This is based on what the pension the deceased would have received at normal retirement age (NRA).

These benefits are;

- Spouses Pension – 50% of your Pension entitlement (excluding any contributory state pension entitlement)

- Children’s Pensions – 1/6th of the deceased pension. The following conditions apply.

- They must be under age 22

- They must be in full time education

- No more than 3 children can claim this entitlement.

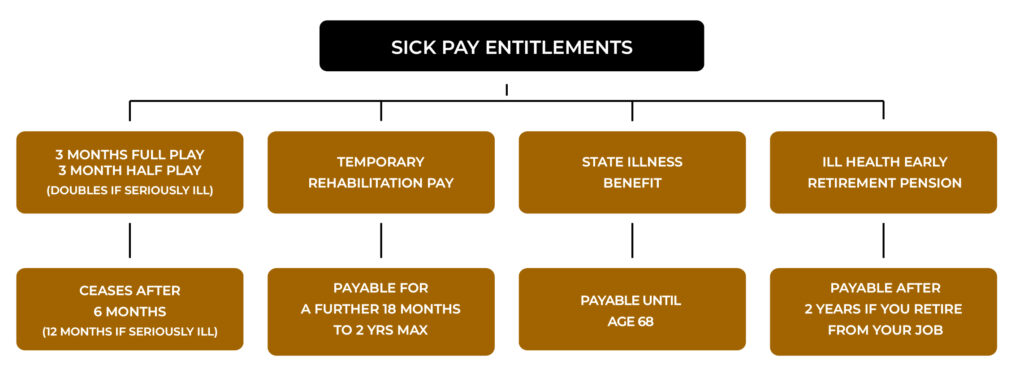

3. Sick Pay Entitlements

A public-sector worker is entitled to the following sick pay entitlements:

- Three months (92 days) full pay in a one year period followed by three months (91 days) half pay. This is subject to a maximum of 183 days paid sick leave in a rolling four-year period.

However, if you have a critical illnesses or serious physical injuries, then the sick pay arrangements doubles to

- Six months (183 days) full pay in a one year period followed by six months (182 days) half pay. This is subject to a maximum of 365 days paid sick leave in a rolling four-year period.

The ‘rolling four-year period’ means that all sick leave (both certified and self-certified) taken over the previous four years, up to the date of the current illness, is taken into account when calculating eligibility for further paid sick leave. A further look-back of 12 months will determine what rate the sick leave should be paid at.

After this leave you may also be entitled to Temporary Rehabilitation Pay (TRP) for a further 12 months. This then ceases after 2 years.

Temporary Rehabilitation Pay (TRP):

If you have exhausted your sick pay entitlements and are still unfit to work, then you may be granted Temporary Rehabilitation Pay. The temporary Rehabilitation Pay calculation is as follows:-

- Pensionable Salary to date x (Actual years of service to date PLUS your ill health Added Years) / 80

- This calculation will be paid for a maximum of 2 years only

- Temporary Rehabilitation Pay will only be available when there is a realistic prospect that you will be able to return to work following your illness.

Health Early Retirement Pay (ERP):

- After you have exhausted your TRP entitlements (2 years maximum) you then have the option to retire early due to ill-health.

- To qualify for this payment, you must be incapable of performing your day-to-day duties and the illness will most likely be permanent.

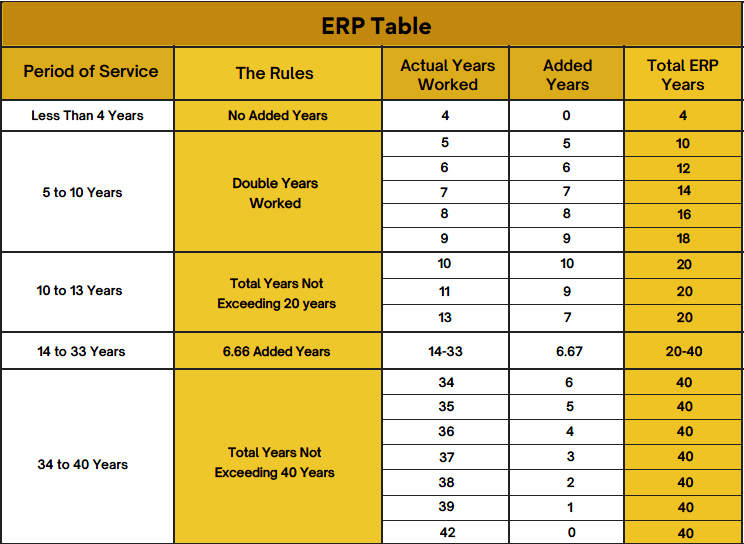

You will be paid an immediate pension and will be awarded ‘ill-health added years’. Please see table below

Other Superannuation rules/Relevant Information

Calculating years of ‘Reckonable/Pensionable Service’

Calculating your pensionable years of service can be very difficult, especially if you moved locations, positions within your career in the public sector. When get closer to retirement, you can request your retirement papers for the relevant public sector department. They will have your reckonable years of service worked out on the statement. However, it is very important to examine this document in detail so that all of your service has been accounted for; from our experience, sometimes it is not.

The following is classed as Reckonable/pensionable Service

- All of your Full time established Service

- Any job sharing or work sharing service

- Any non Established service prior to your appointment to an established post

- Additional Service or ‘Added Years’ granted

- Transferred service

- Any Notional or Actual years service purchased

Added Years Entitlements

Some public sector professionals qualify for additional Notional added years which is over and above the actual years that they worked. The added years differs from job to job. 10 years is the maximum added years with which any employee can qualify for? Some examples include Army Officers, Gardai, and various medical consultants.

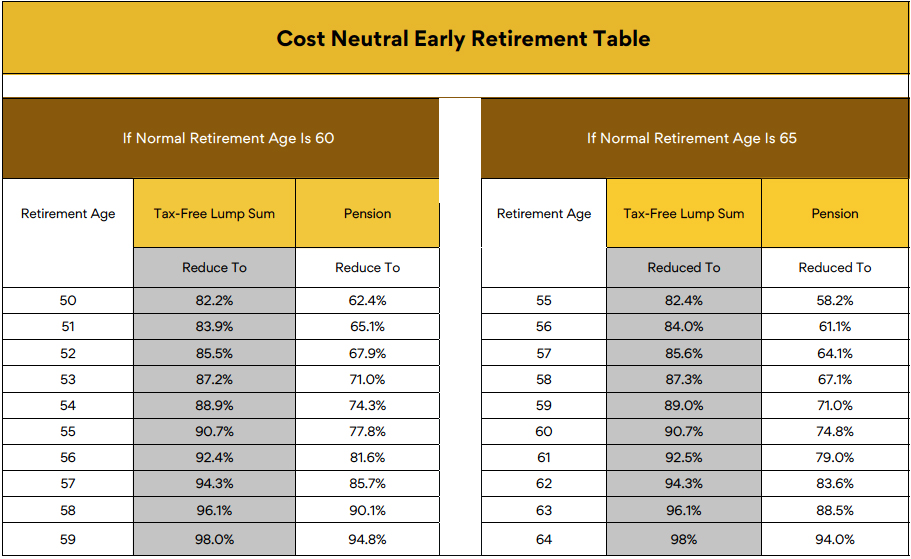

Cost Neutral Early Retirement

If you retire prior to your normal retirement age (NRA), you have two options in drawing down your pension:

- Defer drawing down benefits until NRA to avoid any penalties

- Draw down pension benefits and incur the relevant penalties to your tax-free lump sum and pension.

See table below for breakdown

Normal Retirement Age Rules

If you were employed before the 1st of April 2004 your normal retirement age is 60.If you were employed on or after the 1st of April 2004 to the 31st of December 2012 your normal retirement age is 65. If you were employed on or after the 1st of January 2013 your minimum retirement age is the state pension age (68) to a maximum retirement age of 70.

The 35-year Rule for Teachers

If you are a teacher who has reached the age of 55 and has 35 years’ pensionable service, you may retire without penalty if you wish. Two years will be subtracted from your 35 years if you completed a 4-year training period and one year for a 3 year training period. This is to assist teachers reaching the 35 year threshold. So if you are a primary teacher, you can retire at 55 with 34 years pensionable service as you would have been in college for 3 years to gain the relevant qualification. If you are a Secondary teacher you can retire with 33 years pensionable service (or whatever age you complete 33 years’ service) as your qualification would have taken 4 years to complete.

Remuneration will not fall below €65,000 as a result of the application of the reductions set out above; pro rata reductions apply to staff who work on a part-time or work-sharing basis.

Allowances – Pensionable vs Non-Pensionable

Pensionable Allowances Include:

- Approved special allowances payable in respect of higher qualifications or higher degrees.

- Approved allowances payable in respect of special certificates.

- Approved allowances in relation to special duties, or for working in particular work areas (e.g. location allowances, theatre allowances paid to nurses)

- Living out allowances and approved stand by.

- Approved allowances payable to staff roster within normal working week for the weekend, night, bank holiday duty.

Non-Pensionable Allowances include:

The following are not included in your pensionable remuneration;

- Overtime payments, call-out/on-call allowances apart from the special allowances referred to above, are not normally pensionable.

- Overtime, commission, gratuity, special fees, travelling and subsistence allowance are not pensionable payments.

Maternity Leave Entitlements

If you give birth to a child, or reach the 24th week of pregnancy, you are entitled to 26 weeks paid maternity leave and 16 weeks’ additional unpaid maternity leave. Maternity leave will ordinarily begin on such day as you select, unless medically certified that the leave should commence on a particular date. However, the commencement date must be no later than 2 weeks before the due date and four weeks must be taken after the baby’s birth.

If the birth occurs a week before you started your maternity leave, then the maternity leave must start immediately and the employer must be informed. Unpaid maternity leave commences on the day immediately following completion of paid maternity leave, you have the option to take a maximum of 16 consecutive week’s statutory additional unpaid maternity leave.

If you avail of statutory additional unpaid maternity leave you may be entitled to receive PRSI credits.

Taking a Career Break

You can be granted a career break for any of the following reasons:

- domestic reasons, e.g. child-rearing;

- educational purposes, e.g. to attain a post-graduate qualification;

- Foreign travel

You must have completed your probation period to be eligible to apply for a career break.

If you are still on probation you may be granted a career break in exceptional circumstances, e.g. to cope with unusual domestic difficulties, however your period of probation is extended by the length of the career break. The minimum period for a career break is one year (except where leave is required to cope with unusual domestic difficulties) and the maximum period is five years.

You may take a career break immediately following a period of special leave with nominal pay provided the combined leave does not exceed five years.