COMPLEX DECISIONS & EXPLORING ALL OPTIONS

These are a lot of decisions to be made:

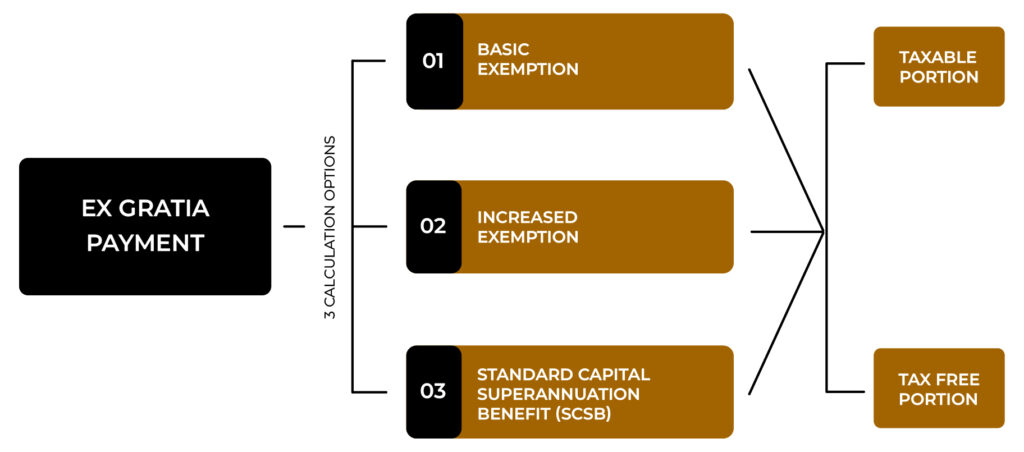

- Calculate your Ex-gratia payment (3 options see below)

What option will you take with your pension ( 5 options see below) - The options recommended to you by your employer may not be the right one for you. It’s important to do your own analysis on the package offered and the options available.

“Knowing and understanding all options is imperative before you make these decisions.”

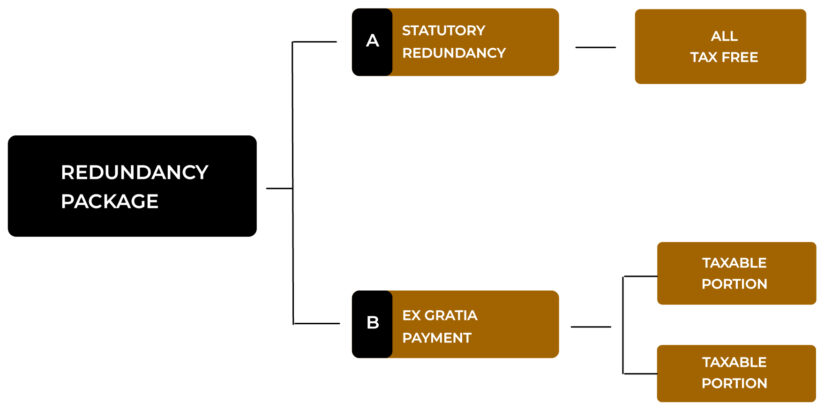

REDUNDANCY ENTITLEMENTS EXPLAINED

Redundancy Packages are predominantly made up of the following.

-

- A Statutory Redundancy Entitlement.

- Ex Gratia Payment

Redundancy Package Explained:

(A) A Statutory Redundancy Entitlement

-

-

- This is a minimum compulsory entitlement under revenue rules that a company is

obliged to offer its staff - All these funds are received by the employee tax-free.

- This figure is calculated as follows.

2 weeks’ pay for each complete year’s service plus 1-week pay (maximum allowed

weekly wage is €600)’

- This is a minimum compulsory entitlement under revenue rules that a company is

-

(B) An Ex Gratia Payment

-

-

- This is an optional extra sum of money over and above the Statutory Entitlement that the

company offers as a goodwill gesture to qualifying employees for their years of service with the

company. - There is a tax-free portion with this payment option any balance taxable at the employee’s

marginal rate of tax.

- This is an optional extra sum of money over and above the Statutory Entitlement that the

-

Ex Gratia Payment calculations

There are 3 options available to all Ex-Gratia recipients in relation to how these funds are split between what’s received tax-free and/or taxable.

These 3 options are as follows

Redundancy Package Explained:

HOW TO MAKE THE BEST DECISION FOR ME?

Before making a final decision, all of the following options and calculations needs

to be examined in detail

Once all of these options are analysed, you will now be in a position to make an informed decision.

It is imperative to seek independent advice on all redundancies as due to the complexity of the calculations, many Companies offering these packages can get the calculations wrong.

They also don’t really analyse the impact your redundancy has on your pension entitlements.